Nearly three-quarters of Australian retirees will receive a ‘pay rise’ on 20 September when the Age Pension is next indexed. This indexation occurs twice a year, on 20 March and 20 September. It is the method by which the payment rates of the Age Pension are kept ‘real’ in terms of inflation, cost of living and movements in wages.

The three key components of indexation are:

- Consumer Price Index (CPI)

- Pensioner Beneficiary Living Cost Index (PBLCI)

- Male Total Average Weekly Earnings (MTAWE)

By keeping up to date with this data, we can fairly accurately predict the indexation weeks before it comes through. Based upon the latest metrics, our calculations suggest a 3.2% increase.

Let’s look at each of the above components of Age Pension indexation to explain how this works.

Consumer Price Index (CPI)

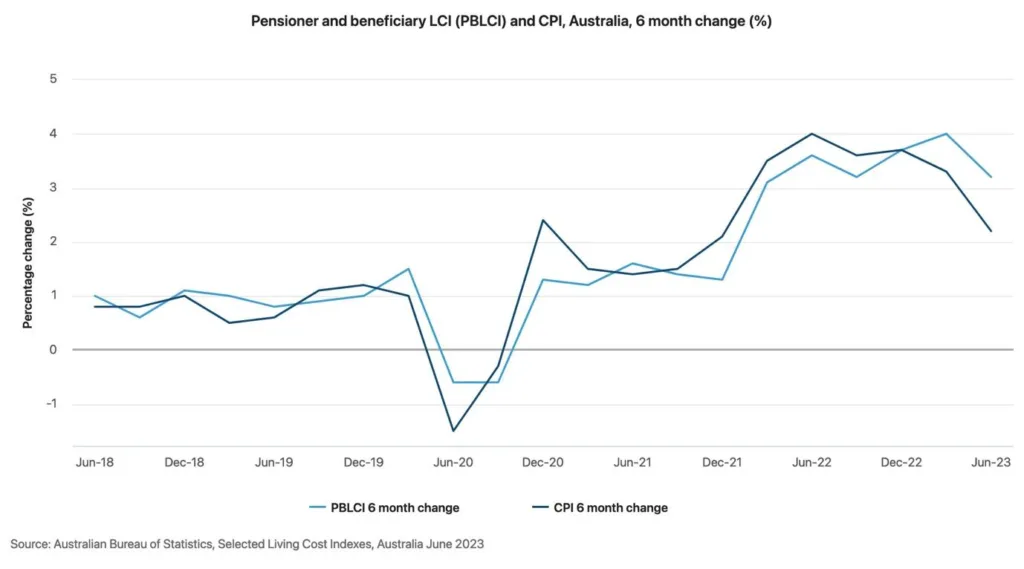

This is a measurement of selected consumer prices over the past month, six months and year. The increase that is used for September indexation is the same for both CPI and PBLCI, the six months change between December 2022 – June 2023. During this time the CPI rose by 2.2%.

Pensioner Beneficiary Living Cost Index (PBLCI)

Living Cost Indexes (LCIs) measures the price change of goods and services and its effect on living expenses of selected household types. The PBLCI measures the living costs for Age Pensioners and other ‘government transfer’ recipient households, i.e. households that source most of their income from government pensions. Over the indexation period (December 2022 – June 2023) the PBLCI rose by 3.2%.

Male Total Average Weekly Earnings (MTAWE)

This index measures the six-monthly movement in the average weekly ordinary time earnings of full-time adults, seasonally adjusted. Essentially a couple’s full Age Pension amount must be at least 41.76% of MTAWE. Age Pension rates have actually grown faster than MTAWE over recent years and this measure hasn’t impacted Age Pension indexation for 14 years.

So you can now see how these sums work. The PBLCI, at 3.2% is higher than the CPI at 2.2%, so it is the main index upon which rates will be benchmarked.

September 2023 Age Pension increases

The Federal Government have confirmed the new payment rates from 20 September 2023 for recipients of the Age Pension, Disability Support Pension, and Carer Payments. Singles can expect an increase of $32.70 a fortnight and couples can expect an increase of $24.70 a fortnight.

| Per fortnight | Current – Single | Current – Couple combined | 20 September 2023 – Single | 20 September 2023 – Couple combined |

| Maximum basic rate | $971.50 | $1464.60 | $1002.50 | $1511.40 |

| Maximum Pension supplement | $78.40 | $118.20 | $80.10 | $120.80 |

| Energy Supplement | $14.10 | $21.20 | $14.10 | $21.20 |

| Total | $1064.00 | $1604.00 | $1096.70 | $1653.40 |

Will other payments rise?

Generally speaking, September 20 only sees increases to the base rates through indexation. Deeming Rates are frozen until June 2024, so these will not change. Other supplements could also be adjusted.

With rentals rising by about 10% year-on-year, there certainly was a case to be made that Age Pensioners who rent are those most in need of some extra support and the Commonwealth Rental Assistance payment has been reviewed with singles set to receive an increase of $27.60 per fortnight at the maximum payment rate while couples will receive an increase of $52.00 per fortnight at the maximum payment rate.

| Maximum Payment | Current Amount | 20 September 2023 Amount | Increases |

| Single per fortnight | $157.20 | $184.80 | $27.60 |

| Couple per fortnight | $104.80 | $123.20 | $18.40 |

| Rent Threshold | Current Amount | 20 September 2023 Amount | Increases |

| Single per fortnight | $140.40 | $143.40 | $3.00 |

| Couple per fortnight | $227.40 | $232.40 | $5.00 |

| Rent Ceiling | Current Amount | 20 September 2023 Amount | Increases |

| Single per fortnight | $350.00 | $389.80 | $39.80 |

| Couple per fortnight | $424.74 | $464.40 | $39.66 |

If you would like to check your current Age Pension eligibility, you can do so using Retirement Essentials free Age Pension Eligibility Calculator. If you would like to learn more about ways of maximising your own entitlements, then talking with one of our consultants in a scheduled appointment will allow you to ask all your questions and share any concerns.

Are you ready for a pay increase?

Will this increase help you to juggle bills more successfully? Or does an extra $31 (singles) or $47 (couples) barely scratch the surface when it comes to managing household expenses? We’d love to hear how you are managing.

Originally published August 17th 2023. Updated September 7th 2023.

Yes, it will help to some extent. However, council rates have risen as have water charges (Qld). Car registration fees have risen (Qld). House and contents insurance have risen. These costs impact on pensioners. why can’t we see a bigger cut by utility providers and insurance companies for pensioners? I know the Commonwealth Government is not an ATM nor is it in a good financial position. I am not a mean person but as I say, these extra costs cannot be easily absorbed by pensioners. Stopping migration would go a long way in solving the rent hikes. I am fed up with migrants who I see as ‘economic opportunists’ coming to my country and sucking the guts out of this country. For instance, how many more overseas doctors do we take in only to see them get as much out of Medibank as they can?. Australians worked so hard at. migration

sorry fella

but bringing migrant ratesinto housing and overseas doctors abusing medicare into the pension equation is simply wrong, wrong and wrong by a country mile

Housing = 10 or more years of abject neglect by the LNP + every State Government.

Migrant are a human resource that Australia wants, needs, and are essential to ongoing economic development, cultural cohesion, taxation and consumerism.

There is absolutely not an iota of evidence that suggests or confirms that overseas trained doctors have or are rorting. MEDICARE. This human resource is essential to the Public Private health sectors. I assure you, and know from professional and personal experience, that these doctors are very often more experienced and better trained than many Australian trained doctors.

All these people that you have disdain. for, are consumers and tax payers and contribute enourmously to the rich and vital fabric of our society communities

Well said Robert. Why has no one paid attention to the rorting by the ‘Top End’ of the town? What ever came out of the ‘Royal Commission’ on banks and the corruption in the police force and politicians? They go ‘SCOTT FREE’ and yet we target the predominantly poor migrants! Wake up Australia PLEASE?

Jayv Pilai

I wholeheartedly agree with Robert’s comments. Apart from the rich tapestry that migrants add to our society. we need migrants, particularly now, in the midst of so many shortages of skilled trades and professionals.

It’s time the dole was cut to a stop measure time for able bodied people instead of a lifetime commitment.

Well said

Really Imagine are the reason there are so many Australians not being able to Rent or get a Job Robert….I worked for the Government for 11 years so I know the truth….The Government brings Theres people here for lower pay….Australia get paid higher wages then most Country…So there way to fixs the hight wages as Big Businesses will not raise Australians wages so the get imagine to come here a they get paid way way less then Australians….When all theres imagine come over the next so many years ,U will see Robert when they have not where to live as there is not enough house been built….The unemployment rate is rising quicker what you can imagine because all these Aussies are losing their jobs to foreign people….So do not say imagine do not impacted Australians and destroying disgraced country that I grew up in and was born here I am an Aussie….Are U Robert….

I will get 24.70 increase in my pension and have notified that my rent will go up 10 .00 per week so I will get 4.70 rise what a joke

Why did I only get a 4.68 increase in my pension?

Hi Marilyn, thanks you for reaching out! There are many factors used to determine your Age Pension so changes in other areas of your income/assets may have offset the increase. For example, at this time of year Superannuation Funds give Centrelink updated balances for your accounts held with them so if your Super has performed well and increased in value then that additional super will reduce your pension and could be the reason why you didn’t receive the full increase.

bullshit bullshit bullshit get educated and observe just what these overseas doctors do do. Stephen is correct in all he says!

These increases are a joke. They do not keep up with the cost of living. We are continually chasing our tales.

The cost of food items and council rates alone will eat up any increases. It’s not as if our lives will change very much as far as standard of living. I feel for those pensioners who are paying rent. I do not know how they live from day to day.

I just feel that increase should be greater for those paying rent and who do not own a home.

Water, electricity, rent, insurance, rego, food, petrol, gas, all up, some almost doubled. Been thru this back when i lived in another country, the movie is beginning to show again…

I an on the Aged Pension and pay rent which is nearly half of my pension, take this and money put aside for electric, insurance, phone etc, and it leaves very little to live on – and with the cost of food going up each week not by cents but by dollars it is getting harder to just survive, yes any amount is welcome but $31 per fortnight is really not going to make much of an impact on cost of living – as it will just push up expenses even more.

With regards to electricity prices, it amazes me that most suppliers only pay the householder a pittance (5 -10 cents per kWh) for solar fed into the grid. They then resell this to consumers at 39.9 cents per kWh – a profit of approximately 700%. Now with a greater number of households opting for solar surely the Government should step in and regulate the feed in tariff.

We have just replaced our 2.4kW system and invested $31,000.00 on a 13.5 kWh Enphase solar system and a Powerwall 2, 13.5 kWh storage battery, using the Green Loan facility available. On our calculations we will generate an electricity credit balance of approximately $1,200.00 each year, save a further $1,400.00 per annum on petrol buy driving an all electric vehicle, and estimate that the total cost of our investment will be repaid over the next nine years. From that point on it will generate an annual income of $1,200.00 and we will not be paying anything for electricity used or for fueling our electric car. The actual cost to run our car will be the loss of the price we would have been paid for the solar energy used to charge the car (1,300 kWh @ $0.76 cents per kWh = $98.80 for the 6,500 km we travel per year).

An additional benefit of this investment in solar power is the value added to the home and its resale price.

Yet, politicians receive hefty pay increases and justify it by arguing that the increase is determined by an Independent Remuneration Tribunal. Aged pensioners would like the same Independent Remuneration Tribunal to determine their pay increase, too.

owning your own home outright goes a long way to making the pension liveable. rents avg 350 to 450week mortgages doubled now.

I agree, no one should be living day to day at our age struggling to just get by,we have paid our way and deserve more.

Doug this pretty much what all pensioner living in state funded housing face. Basically, they don’t care. But let the gardens go unwatered. That is if you didn’t spend a small fortune planting gardens or shrubbery.

Marilyn Brown, The reason why your pension didn’t go up by much was probably because the increase is from 20th September, so if you have been paid very recently, you would have got only a small part of the increase, probably only two or three days out of 14 of the full fortnight. Next fortnight you should get the full fortnightly increase. The pension does not get paid in advance of time. This sort of thing happens to everyone around the time the pension increase is due. It is nothing to worry about.

Stephen, everything what you wrote it’s so true! In a current economic situation we do not want nor need anymore immigrants! We, the Aussies, are suffering enough of hardships as it is because of failed health systems, not enough infrastructure, petrol prices going up everyday, not enough rentals, food prices up. Actually, we can see prices for everything are growing up and up. All govnts, mainly Mr. ‘Abonese’ are blaming ongoing war in Ukraine for all of the ‘above’ etc. Hello, to our PM: ‘ Really, how can a person in your top position, as well your cronies, know about the situation of majority Australians?

Please change your tune, because you have no idea what is really going on, or you don’t want to know! Self interest, power, greed that what our consecutive governments are after when in power! Not the goodness, wealth, well being of the nation. God help ?us!

I find it hard to argue against a controlled program to allow good people from other countries to come to Australia for a new life. I support immigration but I also challenge the government to do more to fix the housing crisis

Agreed and Sam M ozz,s comments on politicians pay rises is so valid ! Why do they do SO WELL in comparison to the general public ? It is sickening !

so true good thinking even our medication had gone up not every one is on the cheap list

We need immigrants who bring with them vital skills. I’m in regional Australia and without overseas doctors our closest GP would be two hours away and that’s if we could even make it onto their waiting list. Furthermore, Australia’s population over 65 is growing fast and outnumbers the population paying income tax. We need young workers, who pay tax, so that the pension, generous compared to other nations, can continue to be paid.

Australia Gov should plan ahead.

we have good students who can thrive to become great doctors without the need of imported professionals.

encourage them with incentives etc…

I am over 80 years old and I pay TAXES. I do not get the age pension from the Government. And my income is diminishing.

We need more immigrants when we can look after the current population living in Australia, with affordable housing, realistic electricity prices, gas, water etc. Why have we sold our electricity? Why do the very rich pay no tax and in many cases receive a full commonwealth pension on top? Assets and trust money allocated to younger members of the families by there dishonesty. Couples who separate but stay in the family home together and live as man and wife receive full single pensions etc. So wrong, yet Centrelink who are aware of these situations allow it to happen.

Albanese plays on being raised by a single parent who lived on a parents payment and pension. He went to a good catholic boys college and to University. Wow! wasn’t he lucky.

I am suffering severely from the increased cost of living. Now we are due to receive our second annual increase, we are told inflation is under control, yet this dose not seem correct after my fortnightly shopping, costing multiple $’s more each fortnight.

Affordable housing, what a joke. I live in one of Unison’s complexes, heavily funded from both State and Federal governments. Last year my rent went up over $30-00 per week. I am now waiting on my annual rent increase to be calculated on my one and only source of income the aged pension. Currently I am paying 40 cents more than the low income earners who took possess at the same time or thereabouts as my increase in 2022/2023. I was told by Unison a low income is based between $42,000 and $68,900 per year. My Centrelink payment is around $30,000 per annum. Big difference when I am paying 40 cents less.

Maintenance is a joke, I have no security door, we are not allowed to have one due to the mistakes made when building this complex. Up until November last year we did have security doors. In May 2022 Unison changed the locks on our front doors to Fob locks, which apparently do not allow for the installation of Security Doors. The complex are studio apartments, only 3 units have air conditioning, five have to suffer from severe heat in summer, no consideration from Unison.

I am an aged pensioner in ill health. I also worked over 30 years, but unfortunately lost my wealth through very bad decisions. I am now very poor financially.

Since we have increased the population in Australia especially in 2023 we have seen a great increase in crime. Violence has increased and is very scary. Violence amongst the younger generation of persons living in Australia is dreadful and a threat to the whole of society. What are the government doing about same? Talk and promises are cheap, results are real. We certainly not seeing any real results relating to the increase in Crime and violence committed by younger people residing in Australia. It is the lack of education in relation to the law.

We have no prisons, thanks to the Labour Government selling everything off, including our detention centres of the youth, both girls and boys back in the early 1900’s under the Kerr government. Many blame the Liberal party, Jeff Kennett was not to blame. He took over a dysfunctional state, Victoria.

Another stated that our pension is generous compared to other nations, this is not true. The Neverlands etc have a much higher pension rate. America does not provide for the Welfare participants and third world countries, including China who does not care about the people.

We are told of inflation and how it is affecting us, yet we are continuing to bring migrants into our country in the droves, they are receiving financial and housing support with promises of free higher education for the young. Is this fair?

I am fed up with lies, deceitfulness by Community Housing, Social Housing and the Government relating to inflation and housing affordability. I like, many other Australians believe this current government does not genuinely care about anything else except for their egotistical selves and power.

With my rent being $720 a fortnight and Electricity, gas and all my other bills including food and petrol, I have $180 a fortnight to live on. Fair? I don’t think so.

Hello Wendy,

I worked all my life in Australia, I served in our military and am now retired.

I have to live outside my country because the pension is not enough to pay my rent, food , electricity , gas and insurance.

It is heart breaking that i had to leave Australia so I could survive. Where i am living there are many Aussies who are in the same boat. We worked all our lives paid our taxes in in numerous cases served our country but our country no longer cares about our situation. Politicians receiving large increases in their pays but not pensioners.

If you want to be fair stop pay increases for public servants and get the government to look into the costs of food to the general public.

I agree with Stephen and Grazyna. We have never had the opportunity to vote no to the incredible number of migrants. Our living standard has fallen immensely while the cost of housing has risen enormously.

The incredible migrants are the ones working in aged care ,driving buses ,trains ,our health system is reliant on intake , at least that is what I see in Melbourne and Sydney .

Our natural birth rate is too low , we are a country of old people , we didn’t have large families ,our middle aged children had even smaller families and our grandchildren ,well women think 35 is too young for motherhood .

migration has been with Australia since1788 and has never lost its popularity ,except during the two major wars ..

The government pays so many others at the expense of age pensioners. I work part time and after about $190 per fortnight 50c in every dollar I earn is taken away from my pension. So effectively I pay about 60% or so “tax”. I have worked and paid tax since I was 11 years old and have earned my pension. Yet those bludgers who have nothing wrong with them except laziness get the results of my hard earned money. This is what I really object to. If a job is available in the local area that a person can do, then they should not receive unemployment. The money saved here could offset money paid to age pensioners who have worked all their lives.

Lee, I also work part time. My work bonus is $300 per fortnight and my pay is nearly $800 per fortnight. I’m losing nearly half my pension payment due to me working those minimum hours!

Why can’t we aged pensioners who are willing and able to work be penalised??

some other countries welcome aged pensioners who want to work get their full pension payment as well as a ‘pay check’!!

those who were the backbone of the country are forgotten.

Try using the work bonus scheme it does work to your advantage

Government wants the pensioners to work part time and get pension as well. Pensioners will then pay TAX from their hard earned money and also pay Tax from centrelink pension as well as 50c deducted per every $ they earn from pension money. What is this? Why pensioners are paying double tax plus less 50c from pension equals to peanuts? Has the government looked into this? looks like pensioners are paying more and double tax. Don’t you think government should look into this and either scrap that 50c per dollar or scrap the tax on pension. It’s too much stress on pensioners. living just on pension isnt enough, doesn’t even get proper food on the table due to the increased of everything in daily living. Can someone have Mercy on the pensioners?

A few items that most people don’t know.

PM Robert Menzies increased taxes in the early 50s by 3 % to cover future cost of providing aged pensions, so any person who has reached pension age is entitled to receive it.

It’s been government policy to have high unemployment to surpress wage increases for over 35 years, these same governments then went on to describe the people they made unemployed as dole bludgers.

Did you realise that more than 1,000,000 Australian expats live and work overseas or at least did before COVID.

The real solution to skills shortages is to provide training to the people who don’t have them.

iam with you mate especially the unintelligent idiots we have got now Morrison BS ed his way in to power and this IDIOT has done the same hope he doesn’t last any longer.

is 250 one off payment going to age pensioners in september 2023

Why can’t everyone, regardless of whether they are single or in a couple, receive the increase of $50 to their Age Pension?

How does Centrelink calculate the increase amount? Given my rent and power bill are each $400, the $30-$40 increase they suggest does not provide much support to paying these bills.

Yes, they did provide $550 in a power bill supplement, but it’s divided amongst all me pension payments I receive, rather than a lump sum. My latest bill was $80 for 20 days of usage (which seems unfair as majority of that was the service fee).

I’d like to reiterate, how do Centrelink calculate the increase amounts?

When divided, the power supplement of $550 should allow for $70, however I only received $20 of this.

After using this to pay my electricity bill, I was left with $58 remaining on the bill, but given the supplement I should have been able to cover these costs.

increases in living costs, most particularly in food, fuel, electricity and insurance costs, well exceed the increase in age pension. Our home insurance costs alone have increased by over $2000 a year!

There was a time when we could occasionally visit our daughter and grandchildren 400 km away, but it now costs more than $200 in fuel alone, so visits are now restricted to the family very occasionally visiting us.

Do people housing commission get that goerment increase

hopefully we do. I been living in Dept Housing since 4 August 2016. Am on lower pension as it not private rental & I pay 45$Fortnight through Centrelink for my Electricity every fortnight. Its the only way I can survive as pricing has gone through the roof

I have not received a renewed pension card since Nov 2022

Hi Tarli, thank you for your comment! Pensioner Concession cards are valid for 2 years so yours will not need to be replaced until Nov 2024. Centrelink usually post the new cards out the month before so you should expect to receive yours in October 2024.

If your on a pension you don’t pay for car registration pal.

If your on a pension you don’t have to pay for car registration only Green Slip.

Health cover rose $17 this month…Energy rose 28% this month. Car insurance rose $13 this month. Just these 3 increases wipe out ANY pension adjustment for September…So how do we pay for the rise in just Food prices…We don’t…You can`t juggle what. you don`t have. Increases should be quarterly

the DSP did not recieve any cost of living rises in July…will it recieve anything in the September 20 increase?

Hi Mark, thanks for your comment! It is possible, Centrelink have not officially confirmed what increases will take effect, this article is us predicting what we might see and is not set in stone.

Everyone must have done their calculations so did U & bottom line is the way of working out pension rise/rate is not logical & doesn’t seem to be right, this paltry amount of raise in pension will be eaten up by two or three bills.

so I would say that this rise is like pouring one bucket of water in an ocean.

what difference will make to the ocean with one bucket of water, same situation is of pensioners.

And that’s why pensioners would never be able to fulfill their wants & will be left with meeting of their needs perhaps.

How can the government expect pensioners to freely spend money & help contribute country’s economy while they are hardly able to make their ends meet ?

Yes there will be an increase 20 September 2023.

DSP and Age Pension are the same rate and get adjusted or indexed whatever at the same time with the same increase twice a year.

Ciao

I went back to nursing am on the age pension use the work bonus organized things with Centrelink I work 20 hours a fortnight paid $669. Report each fortnight have not lost a cent of my pension.

I am on a disability pension and am not only unable to work, but the disability I suffer also includes huge medical expenses. Even if I received an updated DSP, I can’t afford to live. I sold my house and have a small amount (and I mean SMALL) left after the sale. I also sold my third-hand car. So for a year I might be able to survive. After that, what? At the age of 65, I feel way too young to go into a state old age home and share a bedroom. Again, what ? do I do if I can’t afford to live?

once again pensioners who are renting fall further behind in the race for survival. With rent assistance at $160 approximately a fortnight for single people. Rents have risen to the average price of $700 per fortnight for a one flat. So in essence that covers 22.8% of the total rent. then throw in all the other cost of living increases over the last 6 months and you what one can only describe as being in survival mode rather than living. So yes bring in thousands of migrants and throwing money at them doesn’t make sense when the people who paid taxes all their lives are fed with the scraps.

I am eternally grateful for my aged pension. Coming from Zimbabwe forty years ago, I worked for fifteen years before retirement. This is also when all super payments from that country stopped. I have learned to cut corners, but with the huge increases in just about everything needed for basic living, it is extremely difficult. An increase, would be very welcome.

I am a fairly recent part-pensioner, 67 years of age and have worked and paid tax for 50 years. I chose to continue working 2/3 days per week which is good for my health and keeps me connected. I do not agree with these two gentlemen. There are ways we can adjust our spending. Leave the car at home and travel for $2.50 all around Sydney. Registration is free I believe and my water bills have reduced to about $30/quarter! Buy food in season, eat less meat, drink more water – less alcohol. Walk and swim and join your local library (all free). I have rheumaroid arthritis but have learnt use it or lose it!. And don’t whinge. We are very lucky to live here.

good to hear a balanced and respectful voice in this sea of grumbles. I do feel for people who are doing it hard though, and the helplessness they must feel after years of being able to work and live ok, to get old and have to struggle with financial worries which have very real consequences for older people unable to pay their way – homelessness, ill health, and social isolation are very scary prospects when you dont have the ability to work anymore. I wonder if people got together and were able to create some changes themselves in this situation, by sharing ideas, and putting those ideas into practice to make some money. There is a lot that can be done. Good luck to you all.

I still want to be had not eat less meat still I be still eating it as meat out there is still as cheap as your veggies if look around and can find good meat and just good cost as veggies so can still have both yeah chicken etc Yeah!! Just cheap as your veggies etc top’s to be had yeah!!

But both got our options and all else top’s to be had when comes to think that can’t eat meat think high to and just eat more veggies to me think still can eat both top’s to be had yes if look around to be had good in every way can eat in get meat as well as veggies both good as each other yeah!!!

But all else all in all top’s to be had that All Good in both ways top’s to be had in every way!! Yeah!!

But all in all agree all else saying in the message of your’s it only part saying can’t get or eat meat to be get to think can’t get meat and think got to more veggies part sorry not agree to that part think can eat both and just cheap as each other Yeah!! have a good great top’s look around can get both!

How much can I earn a week on top of my fortnightly pension without losing money off my pension ??

Hi Terry, thank you for your question! You can read up on both the income and asset thresholds HERE.

I receive a part government pension and fortunately receive a super pension as well. I am in the “baby boomer” era and been satisfied with life to a point. As our population ages we don’t have sufficient taxpayers to fund this scenario. Fortunately our resources sector provides a money tree which allows the government to reduce our spiralling debt. Governments of any breed are controlled by the different factions within the party. To me their ethos is firstly to be re-elected. I for one think governments should not have long term control as they become too complacent and Morrison is a prime example.

When one analyses the main stigmas for spiralling costs eg food, petrol, electricity and the like their priority is to the shareholders as each companies survives because of them. Consumers run a bad second with mainly supermarkets playing pricing games. The petrol companies have a free spirit whereby petrol jumps by 30 or 40 cents per litre from one day to the next. My next gripe is the rental market. Its existence relies on a supply and demand scenario. For many years the demand has outstripped supply therefore a greed factor takes over with the lessee faced with huge increases to ensure a healthy return on the investment. If you can’t meet the market rental be assured someone else. Fortunately to a degree we need the private sector as governments have no chance of stepping up to the plate. Most of us have lived through the tough times but I think today’s situation is more difficult for the pensioner

I don’t know how long you so called pensioner assistances are keeping your heads in the sand and ignoring what is happening in real life to our elderly since January 2021.

Where centre link jumped on pensioners with working spouses . but exempted them selves from the same treatment of fortnightly reporting your spouses GROSS income (including salary sacrifice & income tax ) to reduce my pension and advocating that I should divorce my spouse to receive a full pension .

In the last 2 years they have taken over services Aust. , ATO , My Gov. what next with their regime building ??? Including new requirements to sign into My Gov. where you have to accept their conditions , one of which states that they have the right to stop your pension for any or no reason .

A very sad and sick way for our retirees to exist .

Laughable, hilarious….doesn’t even pay for petrol for the car…what can I say……The rent has gone up by 21%… food by 5% to 17.5%… it’s a joke. How about a 25% increase…..

Trish I agree wholeheatedly, we can all adapt to live within our means. In regional areas there is not always public transport, no close library or pool, petrol and grocery’s are far more expensive. However, saying that I would not want to live anywhere else.

I find it sad to see the comments here made about migrants. Only a very small proportion of Australian residents are not the descendants of migrants. By all means argue for a better deal for pensioners but without migration over the last 235 years very few of us would be living here with a much higher standard of living than most places around the world.

Yes,I agree!We all “migrants” in Australia in the last 235 years, only some come earlier!We still need “migrants” but ones who come to work,not only come to collect social security pay!

That rise does not even remotely cover the cost rises of power insurance council rates water rates and cost if living Its become a nightmare trying to manage and paying for white goods that no longer last a reasonable time It’s hard even affording medication These indexes they use do not cover actual rises in living costs It’s no Longer possible to afford the heater and absolutely all pleasant things are gone from life It’s frightening

My 91yo home owning, single, mother actually saves money on the age pension. She lives a good life and drives and maintains her own car. She has all that she needs and wants. Her family have never had to help her out financially and she doesn’t use community care services. Just saying!!

What a ridiculous comment to finish off this post “just saying”. Why don’t you have some compassion for those who are doing it tough and stop comparing your mother with others in the community. Your post is as ridiculous as your final comment. Have some compassion.

As you say your mum has her own house paid off I assume.There will come a time maybe when big repairs are required on her property.You won’t be so smug then or will you be paying the costs associated with this?

I also feel for all these people facing financial difficulties, after a lifetime of hard work and paying taxes….but please, fellow Aussies, don’t blame immigration because that is NOT the cause of increased prices and rising rents…I have heard several times recently excellently expressed pro immigration statements but unfortunately my poor memory disallows me to repeat them here…I wish someone who has this type of information would put it up here to disabuse people of their misinformation that their troubles are caused by immigration….I also had to add my 2 cents worth because I couldn’t bear to see this group of people being so insulted and maligned..not everyone in this country feels that way about immigrants…I’m a descendant of immigrants like most on this page.. since European settlement, we are all from somewhere else and no more entitled to this country’s benefits than anyone else.

We need younger immigrants in this country. Have you looked at the last two Intergenerational reports from the Treasury? We have an aging population. Younger people are choosing to have fewer children and are no longer replacing themselves. Who is expected to run the country in the future?

Well said

AT LAST A VOICE GUIDED BY INTELLIGENT REASON WELL SAID LEONIE

Is it better to be paid your pension daily?

A daily benefit provides pensioners the flexibility to access their monies 24/7/365, which means the funds would be available for emergencies or situations where paydays and bill due dates don’t align.

This would help avoid pay day lender, credit card fees and issues while improving cash flow in the economy.

Surely increases in offsetting rental costs must go up in both Sept & Feb in line with cost of living expenses. For example the September increase totalling $64 P/M is only of a slight benefit when my rent has just increased by $44 P/M. Resulting in a net $20 improvement I.E; $10 P/W which buys a paper & a cup of coffee. A net increase of $64 P/M is of great value as it pays a bill without any other infringements decreasing the true value of the rise which helps enormously with meeting the COL’S increasing weekly!

The pension increases are derisive when compared to the inflation of 6%. The cost of groceries have increased (some as much as 40% [as I heard on the ABC news radio this morning]).

The difference between a single and couple combined aged pension will be $600 a fortnight in Sept 2023. Utility bills are very similar for 2 people living in the same household. The cost of living such as, Electricity, Gas, Water, Rates have risen markedly. Not to mention Groceries even for one person!!!!

Monthly bills allows a couple an extra $1200 opposed to a single person.

It has always been difficult once single, but a reasonable increase under todays high living expenses is very necessary!! An increase of $31 a fortnight does very little in this expensive climate!!!

I agree , you don’t hear to many couples complaining. $600 per fortnight extra makes a lot of difference, household expenses are the same for singles. I’m sure that couples don’t pay extra for land rates or fuel or electricity, ect. Maybe a bit extra for food. If couples get an extra $600 how do that work out that a single can live on $1200 a month less . When couples lose a partner and then receive $600 a fortnight less than they will see how hard it is. I don’t say that should get anything less , but I don’t understand how the government thinks that a single pensioners can live on $600 a fortnight less.

I’ve just come onto the age pension, and I am grateful. Stop WHINGING I spent 11 years on JOBSEEKER and survive.

The aged pension should be equal to the minimum weekly wage.If the minimum weekly wage is apparently what is needed for people to live on why then not pay pensioners an equal amount. They deserve to live with some sort of dignity instead of being kept living below the poverty line.

The minimum wage is based on a worker with a wife and dependent children. I don’t know any pensioners with dependant children, although I grant you that some (very few) would surely exist.

I became a single mother in 1970 when there was no benefit available for single parents-child allowance was $2 month (cheque mailed out). I went to work and remained at work full time – (studying to obtain x2 Uni degrees and a grad dip.) I retired at aged 69 years.

I own my own home and car, have a small amount of super saved.

I survive on the age pension beautifully. I do not, and never have smoked, drank, gambled or done drugs. Take a good look at your budget, do without what is not necessary.

Migrants, work and pay taxes which pay our pensions.

The age pension is a safety net for those who were unable for whatever reason to prepare for their retirement. It is paid from taxes (how unfortunate we don’t have a pension fund like the UK to pay pensions). As the aging population bubble is increasing it is essential that we have immigrants who work and pay taxes as this supports pensions among other costs. I would like to see multinational organisations pay their fair share of taxes instead of just taking profits off shore.

As for the increasing costs it is essential to have a budget doing so shows where savings can be made. It is surprising how much you can spend on little things without realising it. Also fresh markets are much cheaper for food items and the reject shop is great for house hold products. I have been able to more than halve my weekly spend.

The Pension has only become a safety net since Super was introduced , to a large majority of retirees this will still be there main income ; as most pensioners now in there mid sixties that have been on an average income since the compulsory Super was introduced would still not have nearly enough to retire on a descent income , and that’s if they didn’t have any bad luck along the way , ie sickness ; unemployment ,bad Super companies , business gone broke etc etc ; the pension is what it is and is not just a safety net .

we do have a “pension” fund like the UK, it’s called compulsory superannuation, the alternative road Australia chose to go down in the 90’s so lots and lots of fat cats could make millions from it for the next 3 decades from excessive fees and charges, not to mention the constant moving of goalposts done by successive governments. Yes it has worked for the lucky few, namely politicians on large incomes and a loaded super fund, but for the average worker?, well maybe we should have introduced a national pension fund, at least it would more equitable for the average worker and not just high income earners.

The $31.09 does not cover the increases in cost of living. It’s clear everyone’s circumstances, ie health, budget, needs and wants etc are different. Such as Sue and her 91 year old mother who does not need homecare, at the moment and owns her own home. In essence correct me if I’m wrong, pensions (ABS Statistics, History of Pensions and other Benefits in Australia [Commonwealth of Australia 1st January 1901] were increased based on the CPI (cost of living) however now the increase is based on the lesser increase of wages, to deliver cost benefit to government revenue. Most standards of living have reduced because for one the sell off of public housing by state and federal governments leaving people destitute, (rehousing to another area is often difficult) , and placing the sale monies into government coffers, not replacing public housing stock, plus we have the privatisation of utilities which has led to price gouging ie ‘supply’ and exorbitant increases via plans etc, [use to be governments owned the power grid]. The $31.09 does not cover the full cost of increases in electricity, gas, water, rates, rents, mortgage, all food, unless you have $2 packet noodles with carrot and cabbage.

Unfortunately, the past governments have crippled the Australian economy by allowing big business and high end wage earners to exploit loopholes, reducing their taxable income while the aussie battler that has work hard all their lives and saved up for retirement which no longer meets the current cost of living.

We need immigration to stimulate the economy, but we need to be more selective. I work in an industry where I see too many that have come into the country under false pretenses and cannot live up to the minimum level of skill to be employable which mean they turn to handouts from the government. There are actually Australian organisations that “help” with immigration and they get paid large amounts of money to make someone seem more appealing and meet the criteria. Some of these businesses operate with a referral scheme where they pass on the contact detail of friends and family overseas for them to contact and repeat the process. This is not fair to the immigrants that deserve the opportunity that Australia provides.

The pension and the increases do not even scratch the surface. The base rate needs to be urgently reviewed please. We are all struggling with inflation.

They need to tax the big end of town more, especially Multi-nationals. Property rates should end for the primary abode of Australian pensioners from age 65.

it appears to me after reading these comment that everyone has missed a few major points.

firstly it does not matter which government is in power, as they are all the same. non of them spend on infrastructure, but to make it worse sell taxpayer owned assets overseas companies. federal gov gives them self a 5% pay increase on base salary alone, as most are on 6 figure amounts is a far cry from $31.90 fortnightly.

these government officials route the system with overseas trips large booze bills get caught crashing cars drink driving yet keeping their jobs. There is a saying (if you pay peanuts you get monkies.) we pay big monies and still get monkies. Another factor in this saga is that there is a conflict of interest as when the prices increase so does the income from G.S.T So why would the government want to curb these increases.They allow housing to get sold too oversea buyers, that dont live in them, this could very well be a blatant money laundering scheme.

As for the fresh food people if they are fresh why when is it that when i get to the core of my pink lady apples the seed have a 3 -5 mm sprout. how long have they been in cold storage. how much do they make from selling their bags. as they are there for us not us there for them and we need ways to carry our shopping why arn`t they covering the cost.

My husband and I are on the age pension (not a full one) and budget accordingly but it is a struggle. Any increase is appreciated but I cannot accept that politicians keep giving themselves pay risesthat they do not deserve. They are the leeches of our society.

The Government keep telling us that they are not giving themselves a pay increase it is an independent tribunal that determines it. However they are not forced to take such a large increase,I don’t see any of them refusing it!!

We are fortunate to live in a country with a social safety net. BUT it came about when most Australians also had extended families who helped support the older folks in a day when the demographics meant that we were NOT an aging population. So it was very welcome and what a rich country should do, when in 1909 the pension was introduced. However with two world wars and returning service personell after 1945 the pension was a good thing and not every one needed it . As we are now an aging population with MANY having their own super and housing wealth in the economy, those that DEPEND and RELY on the pension are now not so well off. They are NOT on the pension because they planned for their lives to fail. Most are there because life’s circumstances got in the way and most do not own property. Those that judge them have not walked in their shoes and when you hear of C E O’s getting a bonus annual payment of say 10 Mil $ and the average wage in Sydney over $2,000 a week, with MANY pensions unable to work due to age, illness or infirmity, then what is happening is criminal. The withdrawal also of small things, like the NSW regional travel card ( stopped by the Labour Govt) , paid parental leave to people IN employment, Government minisiters and their rorts like travel expenses when sometimes they technically DONT travel, the UNJUSTIFIED increases in food prices, expressed in percentage terms it is extreme for some items. An unwillingness for a PENSION VOICE TO PARLIAMENT! And MOST aging people these days live alone…………………..DISGRACEFUL FROM ANY GOVERNMENT !!!!!

All I read hear from most people on here is they are never satisfied with what the increase is they want more. If you live in a Housing Trust and on the Pension You pay a reduced rent which is not more than 25% of your pension. You get concessions on your Power bills and water bills and on your car registration and drivers license and if you live in S.A .in Adelaide you get free public transport. Also you pay less for medication. I am in my late 70’s and can manage quite well. Those people calling for the pension to be increased to the base rate still want all the perks to go with it. Shame on you.

by constantly giving pensioners less than the true cost of living increases, you are in fact taking money from the economy,How you may ask. most pensioners spend their money giving 10% g.s.t, then can’t afford their coffee, their fish and chips once a fortnight, drive as much, How long before business will reduce staff more people on center link less tax going to government. You may think this is tinfoil hat area,But the new chair person of the reserve bank has publicly stated too curb inflation we should increase unemployment. this is from a person on 300000 per year plus i would guess bonuses.

these ridicules pay given to them self should be justified by interdependent people.

this is our money not theirs.

all Australian government are the same,federal state and council. they all abuse the trust the voters place on them when voting. one has to ask the question where are the reporters.

so yes we should be thankful for the pension but we should not stand with cap in hand. If the government is doing what we voted them to do listen to the people and fix this pay.

how many council areas have had action taken against them,

These percentage pay increases should stop.as it just increases the gap between the lowest wage and the top end wage. all pay increases should be the same for everyone (as an example if we decide to increase the lowest income by 100.00 wky, then that’s what everybody gets.

if you think our governments are all honest and above board just think back to when the English parliament was rocked by members using tax payer money to fix their houses , well that couldn’t happen here BUT wait one using gov helicopter to go to daughters wedding how many have rental and can still vote on renal issues or negative gearing. matters, one could say a conflict of interest

if the government gives $500.00 a year strait to the power companies and there is say 1 million pensioners that’s 500.00 million per year just from the gov, So why all the increases. Time they justified their increases and not because of over seas wars.

come clean how much do we give to wars. where are the reporters?

I get a part Centrelink pension and my husband’s superannuation pension. I get 2 adjustments per year set against the CPI, but when I get them which is around $15 per fortnight, my Centrelink pension goes down around $10, so according to c’link, my cost of living rise is $5, not quite fair

My only income is the age pension. I have a cat, his box of food which lasts just over a week is currently $13.50 and if figure of $32.70 per fortnight for a single age pensioner (I am a widow who has never had children) then that increase will pay for two boxes per fortnight with five dollars left over unless the price of his food goes up. That is only for the wet food , does not take into account the biscuits I buy for him and I do not buy the most expensive brand either. I paid off the mortgage on my house a couple of years ago (very long story as to how I even still have a house) yet it needs so much money spent on maintenance that I cannot get done because tradesmen are so expensive, they generally will not come to the party in having financial payment plans put in place so the condition of my house is getting worse each week and I cannot afford to sell as what I would get for the place would not allow me to buy another. It is about time the politicians were made to live solely on the pension they would get such a rude shock they would not be able to manage. The prices in the supermarket do not go up weekly, they go up daily and then there is the cost of water, gas, electricity, council rates , public transport fares, postage stamps go up, magazines, papers etc go up and all go up by large amounts, the only thing that does not go up a decent amount is the age pension and the disability pension is worse in a way because it is the same amount as the age pension and for a person to be on a disability pension would mean they have the extra initial cost of all their medications and any ongoing treatment they have to have. To my knowledge this latest increase still has us pensioners being forced to live on an amount that is below the poverty line.

I am a healthy 76 year old and luckily living in an independent living facility. I have a fortnightly budget of which $306 goes to the I.L.F., $400 for food, fuel, etc., and $300 goes aside for all other bills. I am left with approximately $140 from each pension which I can save. I feel extremely lucky that I can manage very well on the pension and find I don’t have to go without things I like to have or do. I guess I’m one of the lucky ones after reading many of the above comments.

what’s the point of an increase,, when community housing take most of it .. I am no better off…

I read this article in August and was expecting a much-needed DSP increase.

I just checked into my mygov account now and there is already the payment for the 25th of September and 9th of October listed without any increase. This did not happen before, and every September and March there has been a slight adjustment. I don’t understand why there is no change in the amount.

Does anyone have the same experience?

I had advise that my next age pay on 21st September will be same as on 7th September. Is this correct? What date payment increase I should received?

Hi Slavko, thank you for seeking further clarity! The changes don’t come into effect until 20th September which means you will see it from your next fortnight’s payment after that on 5th October.

Something that has concerned me for a long time is WHY these shiny arses (ned kelly in a suit) sit on different boards, cut costs and services and then get a massive pay increase/bonus. You only have to look at the current qantas saga to see what the former ceo will walk away with, even if he does not get the paltry 14m that he is due for, he has already pocketed somewhere in the vicinity of a 100m and he just walks away to leave the current ceo holding the bag but she was part of the board when all of this happened and she is just as responsible. THE WHOLE BOARD NEEDS TO BE SACKED AND NEW PEOPLE PUT IN PLACE BUT THAT WONT HAPPEN BECAUSE THEY KNOW TOO MANY PEOPLE IN HIGH PLACES. THE WHOLE SYSTEM IS CORRUPT!!!!!

The cost of fuel, food and basic items are the items that have had significant increases. The essentials seem to have been the hardest hit. Oil prices don’t justify the price per Lt for fuel, in the first quarter this year BP listed a record profit of $9b. Why wouldn’t they. Hardware items building products have all had remarkable increases. I can’t believe the amount of increases that have been attributed to the conflict overseas. We don’t get our fuel from Russia. I, like a lot of other people, are sick to death of the corporate greed that’s happening in Australia at present. Companies are entitled to make a profit but not to gouge us.

I welcome the pension increase but I think its more important that the Government stop cutting pensions to pensioners who are working to make ends meet. Not only are these part time working pensioners (like me) making the effort to contribute to society, we are also paying taxes and believe it or not also being taxed on the decreased amount of pension we get – a double whammy. After working for over thirty years and paying taxes, I believe it is my right to be paid a full pension irrespective of whether I am working or not.

Last Tuesday when we got our pension the increase was $5.20each. How come that isn’t even half a weeks pension